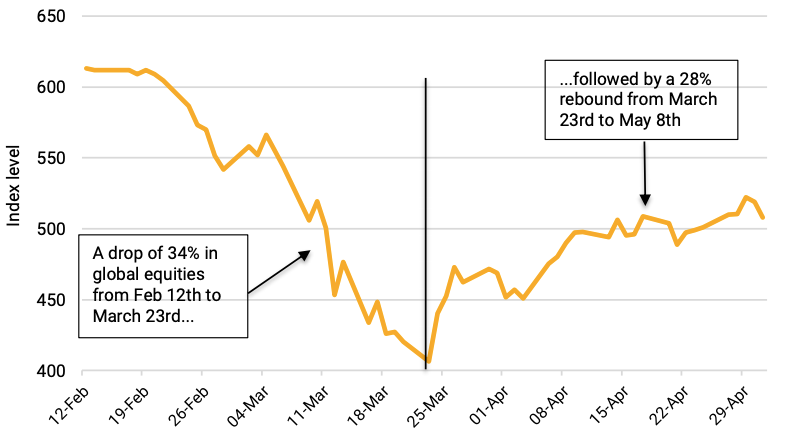

In this report, the first in Sustainalytics’ new Portfolio Research series, we offer analysis about where investors can get the biggest “ESG bang for their buck” as they navigate the COVID-19 market recovery. While global equity markets are a long way from reaching their pre-pandemic peak, they have rebounded sharply in recent weeks, as shown in Exhibit 1.

Applying unique ESG at a reasonable price (ESGarp) scores, we show where investors can find stocks with low levels of ESG risk that also trade at a relatively low price to earnings (P/E) ratio. We expect this will be an increasingly important quest for investment managers in the future, as the COVID-19 outbreak is likely to further raise the market’s interest in ESG integration and boost demand for stocks with a low ESG risk profile.